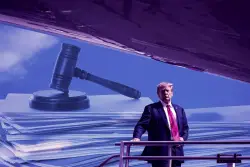

Jill On Money: Debt, deficit, downgrade

The Republican-led House of Representatives has passed its One Big Beautiful Bill but before you dig into the more than -word tomb it s perhaps better to wait until the Senate puts its imprint on it Related Articles sources of emergency cash ranked from best to worst Jill On Money Financial advice for college grads Californians are late paying of their trainee loans Jill On Money Career advice for college grads Jill On Money Consumers feel the heat amid Fed meeting The basic outline is what bulk expected the extension of the majority of the Tax Cut and Jobs Act passed under the first Trump Administration an increase of the state and local tax deduction SALT for various elimination of taxes on tips and overtime pay an enhanced child tax credit among other goodies Before diving into the cost of these goodies and the impact on the nation s finances we need two definitions Deficit The deficit is the nation s revenue the amount of money that the ruling body takes in minus the amount of money that the regime spends For fiscal year the Congressional Budget Office CBO projects a federal budget deficit of trillion Debt The total amount a country must borrow to fund its annual deficit At this moment the U S national debt stands at a staggering trillion of which nearly trillion is held by the residents which includes the Federal Reserve The balance is held by the leadership itself intragovernmental like Social Shield and federal employee retirement funds The debt and deficit levels have grown substantially over the past years According to the Treasury the the bulk crucial drivers of the increase include the Afghanistan and Iraq Wars the Great Recession and the COVID- pandemic Additionally tax cuts stimulus programs increased authorities spending and decreased tax revenue caused by widespread unemployment generally account for sharp rises in the national debt Now back to the bill the CBO disclosed its first comprehensive estimate of the bill and uncovered that it would add trillion to deficits over the next decade Incorporating our estimates of interactions and the adjustments released by House leadership we estimate the bill would add trillion to the debt These numbers have put the U S credit rating under the microscope A credit rating measures the ability of a company or a cabinet to repay its debt Until the U S maintained the highest rating from all three of the big agencies Standard Poor s Fitch and Moody s During the debt ceiling standoff S P cut its rating and has never restored it and then in Fitch did the same Earlier this month Moody s cut America s sovereign credit rating by one notch noting that successive U S administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs As of April it cost billion to maintain the debt which is percent of the total federal spending in fiscal year Although Moody s downgrade occurred before the bill was passed their analysis assumed that the TCJA would be extended Moody s expects that deficits will widen driven mainly by increased interest payments on debt rising entitlement spending and relatively low revenue generation The issue is chronic Political incentives favor spending over fiscal discipline and the math of compound interest works against the U S when it comes to debt reduction What will it take for fiscal adjustment Chances are that the bond industry will make the clarion call just like it did with tariffs and threats to the Fed Chair s tenure If long-term bond yields rise and lead to a sustained period of elevated borrowing costs it will be more expensive for the establishment to borrow new money This creates a vicious cycle higher borrowing costs worsen the fiscal picture that led to the downgrade in the first place That rinse-repeat cycle can only persist for so long Related Articles Groups head to California Supreme Court seeking to upend solar rules Santa Clara County sues local Metro by T-Mobile stores in groundbreaking wage-theft incident Antioch hospital the first in East Contra Costa to offer robotic surgery Rep Ro Khanna local labor unions denounce federal layoffs Wealthy Silicon Valley district faces fiscal collapse Jill Schlesinger CFP is a CBS News business analyst A former options trader and CIO of an financing advisory firm she welcomes comments and questions at askjill jillonmoney com Check her website at www jillonmoney com